Understanding ATM strategy

Exchange

NSE

Strategy

Straddle

Instrument

BankNifty

Risk management

Please refer to risk management guide before going through this guide, to understand the ATM strategy behavior

Straddle Strategy

Straddle is buying call and put option of same strike price. For scalping, we use the same strategy with some modification for different scenario

Visual guide: strategy execution flow

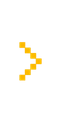

Double Long and Hedge ReEnter

Diagram 1 shows, how we enter with x quantity, followed by compulsory hedge and then take another same x quantity and finally booking profit by squaring off

Diagram 2 is same strategy but this time we are in loss and to protect our capital, we quickly ReEnter our hedge

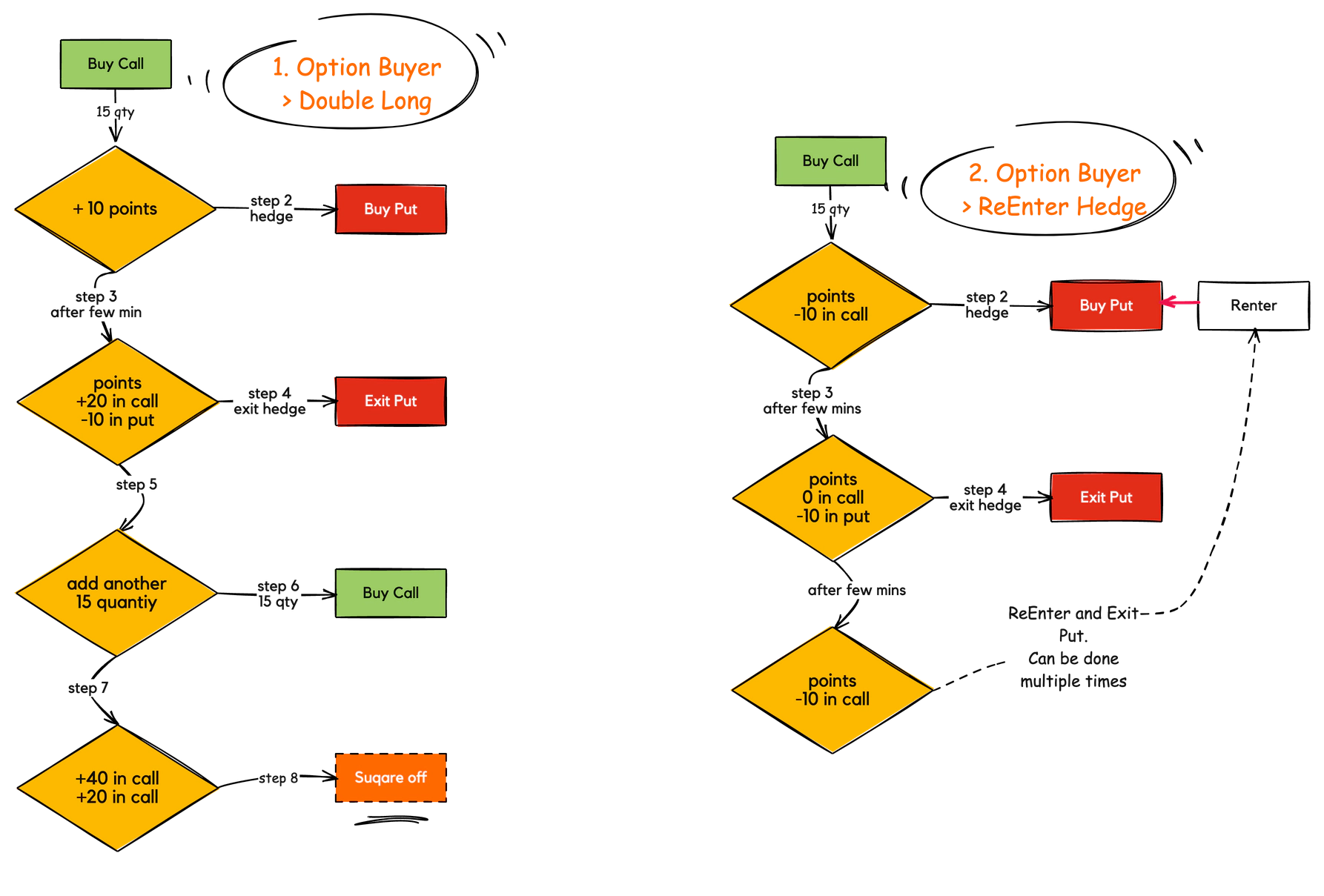

Double Long, ReEnter to single

Diagram 3 shows, we were in profit, but after exiting hedge and going double long, we incurred loss. We reduced risk to half, by exiting additional call and reentering put.

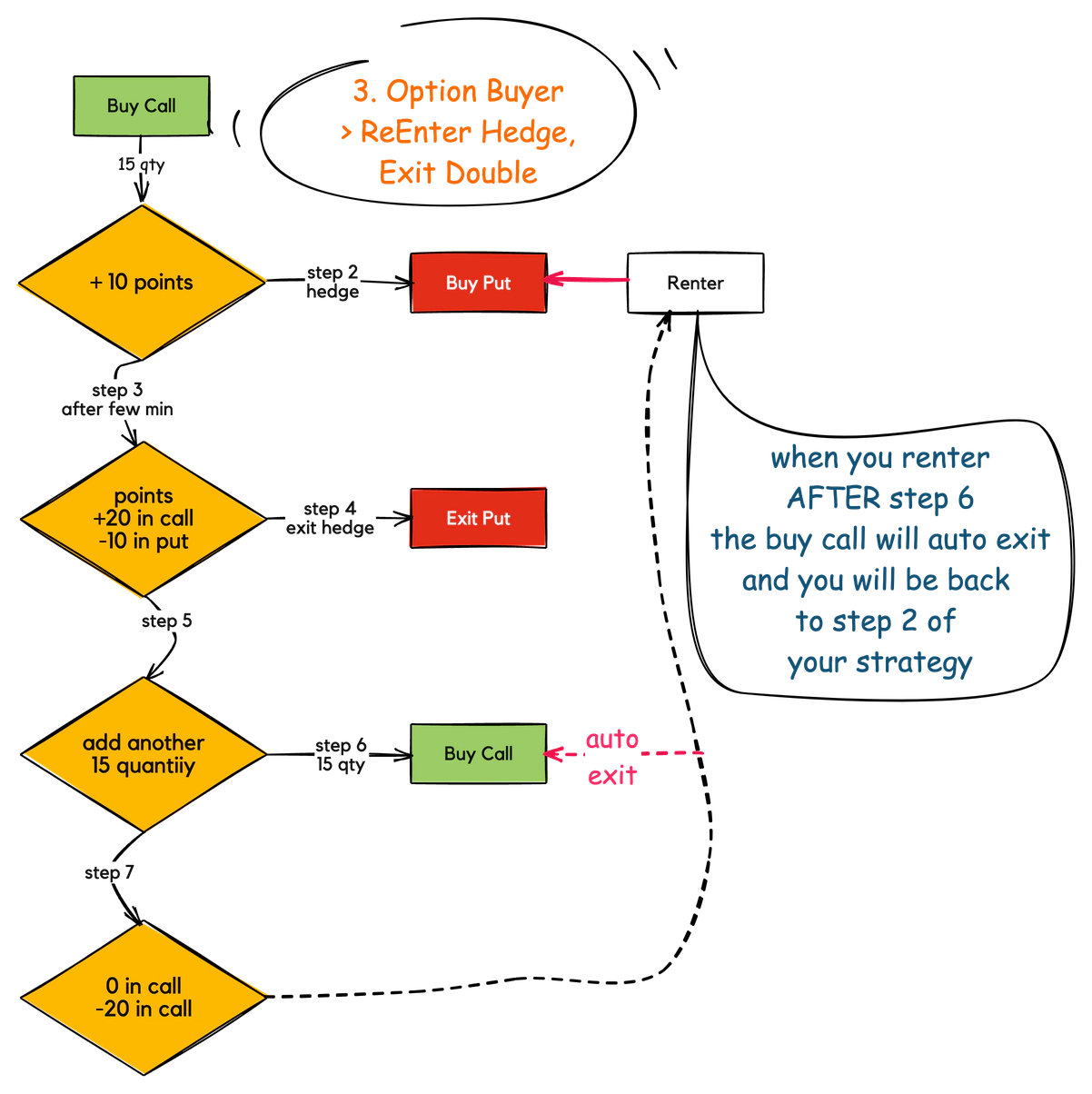

Double Long, Double Hedge and ReEntry Hedge

Diagram 4 shows, we went double long, but since we were sure of trend we decided to double hedge our long and will exit and renter hedge as required

Diagram 5 shows, we can change our strategy on the fly we can exit, ReEnter both single and double quantity be it call or put

More on, Default, ITM Double Straddle strategy

Full Double straddle strategy for scalping is shown below. You can adjust order and money part as per your preference only on request.

when you hit Enter ⏎, order is placed as per step number

[

{

"step": "1 & 3",

"order": "buy call",

"money": 100,

"reenter": "yes*"

},

{

"step": "2 & 3",

"order": "buy put",

"money": 100,

"reenter": "yes*"

},

{

"step": 4,

"order": "to be decided",

"money": 100,

"reenter": "no"

},

{

"step": 5,

"order": "to be decided",

"money": 100,

"reenter": "yes"

}

]

We have covered everything, but if you still want to deep dive in strategy order flow you can go through below steps

Let’s understand the full order flow. The pnl points show below not related to visual diagram above.

case 1: Option Buyer, Long strategy

we suggest that you open the terminal and type try@scalper.exchange ⏎ while understanding this guide

By default, it will buy ITM strike at 100 points from spot.

Consider we are scalping with 1 lot, 15 quantity

Wherever you see ⏎, we are hitting Enter button to place next order

⏎ step 1The 1’st order isbuy call, 15 quantity⏎ step 2The 2’nd order isbuy put, 15 quantity, the hedge partat this point a.we are 15 quantity call and 15 quantity put⏎ step 3The 3’rd order is to exitstep 1 or step 2

In this case we exit the hedge part, that is, we exit put⏎ step 4The 4’th orderto be decidedis nowbuy callat this point b.we are 30 quantity call(double long)and 0 quantity put- we have two options from here

- option 1 is to

hedge (double long)by hitting Enter and executestep 5 - option 2 is to go back at point

a, byreentering step 2 or 1, In this case, webuy put(reenter), step 2 againstep 4, that is buy call getsauto exitand we doreenter

- option 1 is to

⏎ step 5The last and 5’th order is the double hedge part for what we bought in step 4

In this case we buy 30 quantity putat this pointwe are 30 quantity of call and 30 quantity of put- we now have three options from here

square offclose all our positionexit step 5that is exit 30 quantity put and stay long with 30 quantity of call- we can always

reenterthis step

- we can always

exit step 1 & 3that is exit 30 quantity call and short with stay 30 quantity put- we can always

reenterthis step

- we can always

- In this case we will stay Long and either

square offor keepexit and reenter step 5(buy put)multiple times

case 2: Option buyers, Short strategy

This is the exact opposite of Long Strategy,

Step 1is buy putStep 2is buy call, rest everything follows as it is

case 3: Create your own strategy

You are free to adjust order and money part on request only, but understand that scalper.exchange is designed for fast scalping, hence the Default strategy is the way to go.

- you can design either Long or Short strategy

- you can then convert the same strategy from

- Long to Short by pressing

Shift+S - Short to Long by pressing

Shift+L - what it does is, it flips orders

- buy call becomes buy put

- similarly, sell call becomes sell put

- Long to Short by pressing

- always test your strategy in paper trade mode, before going live

The Idea

- Idea is straightforward, to

scalp quicklyand tostay properly hedged - always take

half the quantityinfirstorder tominimizetherisk - hedge immediately with the next order in strategy

- then

exit the hedge and go fullquantity - adjustment/risk management is important hence

reenter, hedge if in doubt